Triathlon Group’s Industrial Report – Spring 2025/26

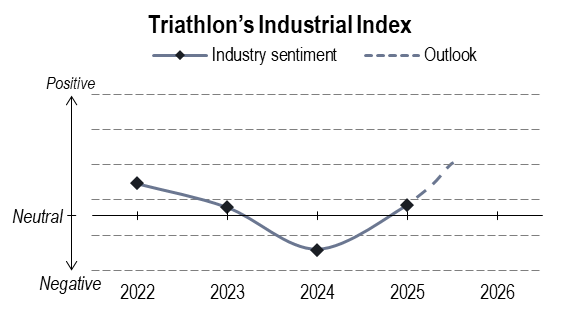

Triathlon Group’s Spring 2025/26 Industrial Report notes a good start to 2025, following a strong Q1. However, rising uncertainty in Q2 has made the outlook for the rest of the year more cautious. Still, expectations for 2026 remain positive, with forecasts pointing to stabilization and improved margins.

Good Start Followed By Market Uncertainty

2025 started strong, with robust demand in Q1 compared to 2024. However, uncertainty increased during Q2, leaving forecasts for the remainder of the year more cautious. Still, revenue projections indicate stabilization in the second half, followed by a strengthening business environment with higher sales and margins in 2026.

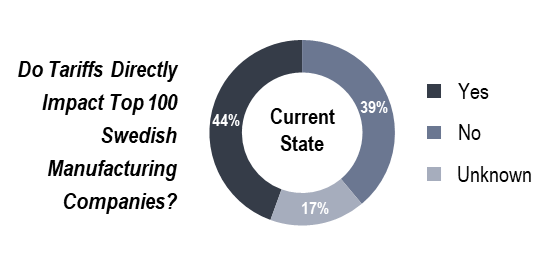

Tariffs Trigger Fear of Broader Downturn

While some companies report direct impacts from new tariffs, the concern is widespread. Most are holding off on immediate action, focusing instead on monitoring and scenario planning. This ongoing uncertainty risks amplifying downturns and broader recession fears across the industry.

Cautious Optimism Builds Toward 2026

Looking ahead to 2026, optimism is strong among Swedish industrial companies. Expectations point to rising revenues, improved profitability, and renewed investment momentum. Triathlon’s Industrial Index reflects this sentiment, with anticipation of market stabilization this autumn. Many are planning to meet expected growth while largely maintaining current workforce levels.

About Triathlon Group’s Industrial Report

The Industrial Report surveys the 100 largest Swedish manufacturing companies, providing a forecast for the sector. It highlights expected revenue, operating margins, and workforce, compiled into the Triathlon Industrial Index. The index places current industry sentiment in historical context, providing insight into market trends.